IMPACT OF ANCILLARY REVENUES IN THE AIRLINE INDUSTRY: PREPARING FOR THE NEW NORMALITY

Evangelos Kilipiris

University of the Aegean, Greece

Introduction

Liberalization of the industry, global financial crisis, surge of operational costs, as well as fuel prices, created a highly challenging environment for the airline industry over the last decade. Last year another challenge added to this challenging equation, it is the global Covid-19 health pandemic. Moreover, competition of ticket fares closely to marginal costs raised dramatically, creating narrow margins for profit (Tretheway & Markhvida, 2014). In this scenery, profitability for the airlines became a major issue and the need for new strategies became a necessity.

Although, the constant seek for maximization of possible revenue streams, was always a common characteristic among airlines (Rouncivell et. Al., 2018). Airlines introduced a new approach to generate additional revenues from activities not related to the ticket sale, such as dynamic packaging, advertising and retailing (O’Connell & Warnock-Smith, 2013).

Ancillary revenues defied as the “revenue beyond the sale of tickets that is generated by direct sales to passengers, or indirectly as a part of the travel experience” (O’Connell & Warnock-Smith, 2013; IdeaWorks, 2019) and rapidly they became an important part of airlines’ pricing strategies, affecting deeply the marketing process as well as the customers’ behaviour (Tuzovic et. Al., 2014).

Through years, revenues from secondary sources turned into a significant issue for the viability of airlines, their marketing strategies as well as the change of passengers’ travel behaviour (Leon & Uddin, 2017). A new trend introduced into the industry and its development tend to play a crucial role for its future.

In addition to these challenges, the global health crisis added another layer of challenges for the air transport sector. The industry projected a reduction of 60% on air traffic, in 2020 (Hermes Air Transport Group, 2021), while at the same time the entire industry faced a significant downturn on incoming revenues. However, heading towards to the end of this pandemic, we enter to a new normality. In this unknown scenery, both airlines and airports deploy new, as well as innovative, strategies to use ancillary revenue streams, in order to regain revenues, enhance the passenger experience and create customer loyalty.

Mostly focus on secondary information sources, the article introduces the phenomenon of the ancillary revenues in the air transport industry, as well as their impact on the formation of airlines’ and airports’ financial strategies. At the same time, the research introduces the way aviation industry implemented ancillary revenue strategies both in the period of the global health pandemic as well as the future initiatives towards the evolution of such secondary revenue streams.

Ancillary Revenues: The new trend in Aviation Marketing

The constant penetration of new entrants in the airline industry caused significant decline on airlines’ yields (O’Connell et.al., 2015) and quickly boosted the implementation of ancillary revenue strategies.

According to Amadeus (2011) and IdeaWorks (2019) ancillary revenues can be identified in five (5) different categories:

1. A la carte features

2. Commission-based products

3. Frequent flyer activities

4. Advertising Sold by the Airline

5. Fare or Product Bundle

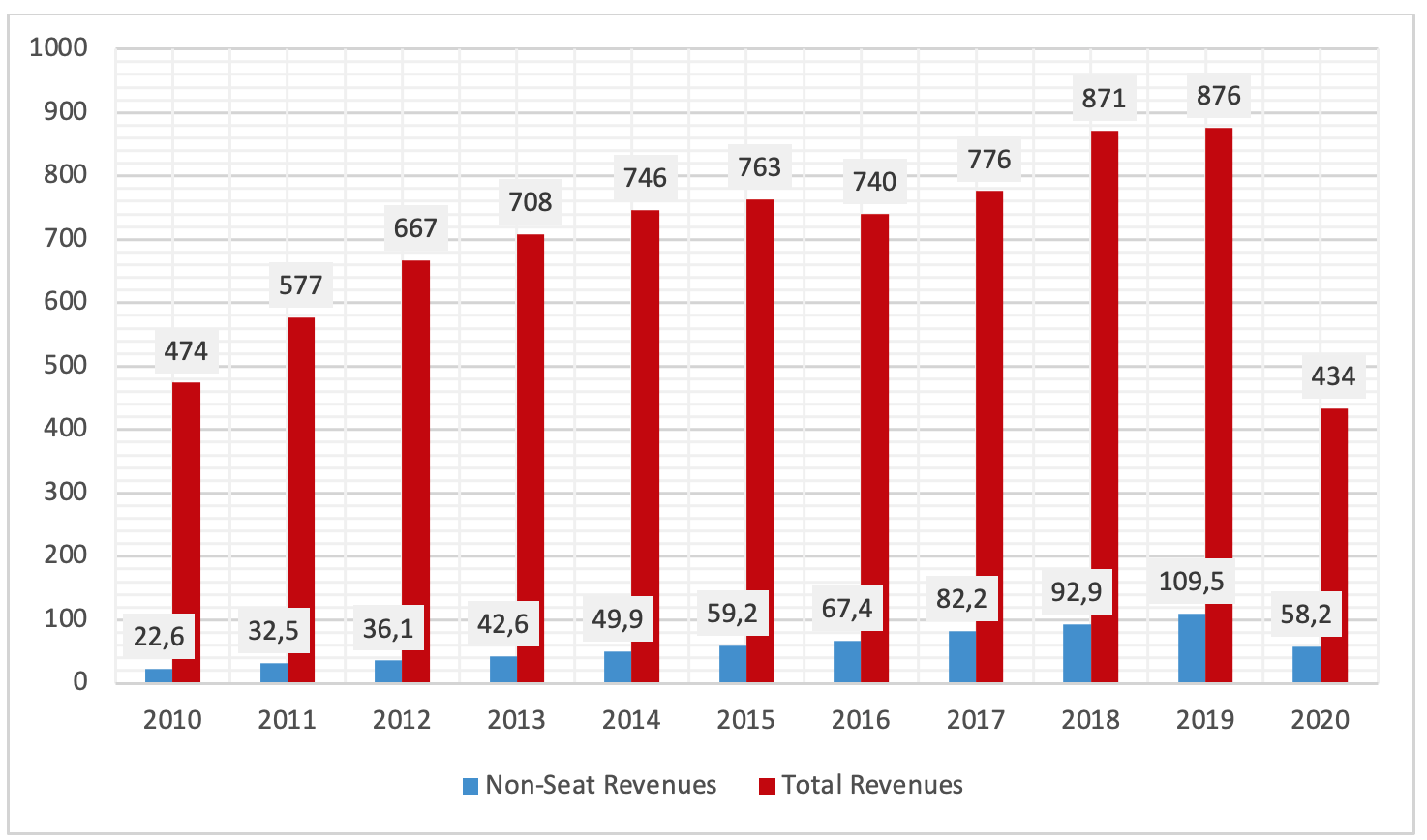

Ancillary revenues rapidly evolved in the industry presenting an expected income of 93 billion dollars (IATA, 2018; IdeaWorks, 2018) for the airlines. Both Full-Service Network Carriers, as well as Low-Cost Carriers, follow several ancillary revenue tactics (Onboard Hospitality, 2011) and adjust them in their campaigns as their competitive advantage against rivals. According to Diggin Travel’s survey on digital merchandising (Diggin Travel, 2018), ancillary revenue strategy is listed as one of the TOP 3 priorities for airlines to increase their profits. The graph below (Graph1) presents the growth of airline revenues generated by secondary sources for the last nine years (Ideaworks, 2018):

Graph 1: Comparison of Airlines’ Non-Seat & Total Revenues (in $Billion) SOURCE: IdeaWorks 2018; Statista, 2021; IATA, 2021

It is easily understood that, ancillary revenues represent a significant part of airlines’ total revenues and they seem to surge rapidly for the last nine years. Airlines’ income from ancillary revenues quadrupled only in seven years and appears to have a continuous increase in the future.

Seat selection, baggage fees, frequent flyer programs and advertisement on website are only few of the products which airlines use through the method of “product bundle pricing” or “price bundling” (Lee et al., 2011; Yan et. al, 2011). Low-Cost Carries immediately embraced such tactics (O’Connell & Warnock-Smith, 2013) and fully implemented them into their pricing strategies, offering to their customers a variety of services in a combined product. In 2018, Ryanair presented an annual profit of 2 billion euros from ancillary services (Ryanair Annual Report, 2018), when at the same time EasyJet generated more than 1,2 billion GBP from its non-seat services (EasyJet Annual Report, 2018). Low-cost carriers were the first to use extensively the ancillary revenue business model as a way to give exclusiveness to their passengers, allowing them to decide how they will build their own fare (Gustavo, 2013).

Furthermore, the emerge of the Low-Cost model as well as their focus on unbundled products, also affects the traditional carriers as well as pushes them to transform their structured products in economy class (Hoszman, 2015). For example, Air France and KLM both implement charges on check-in baggage within their European routes, although they exclude long-haul routes (Air France, 2019; KLM, 2019). The impact of the penetration of Low-Cost Carriers affected Mainline carriers too, turning them to adopt ancillary revenue policies and slightly transform their traditional service model.

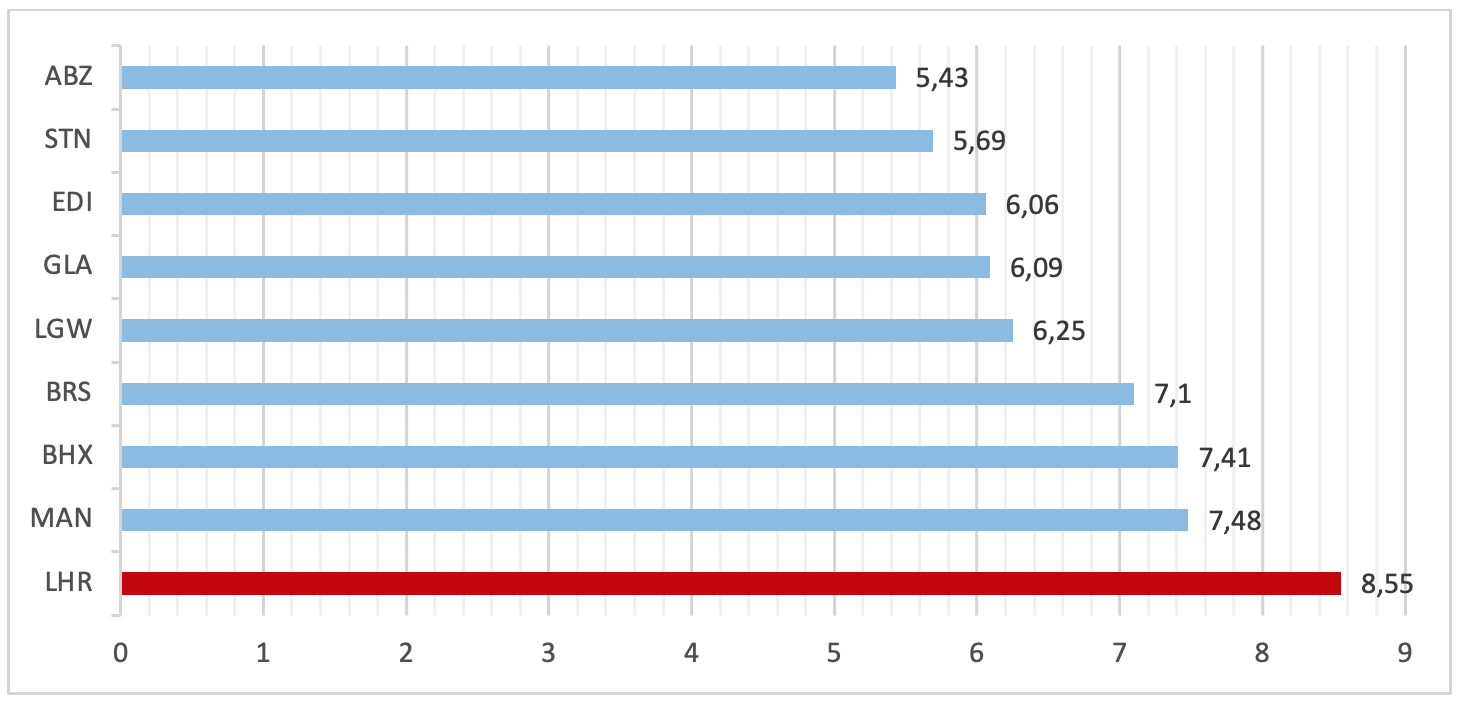

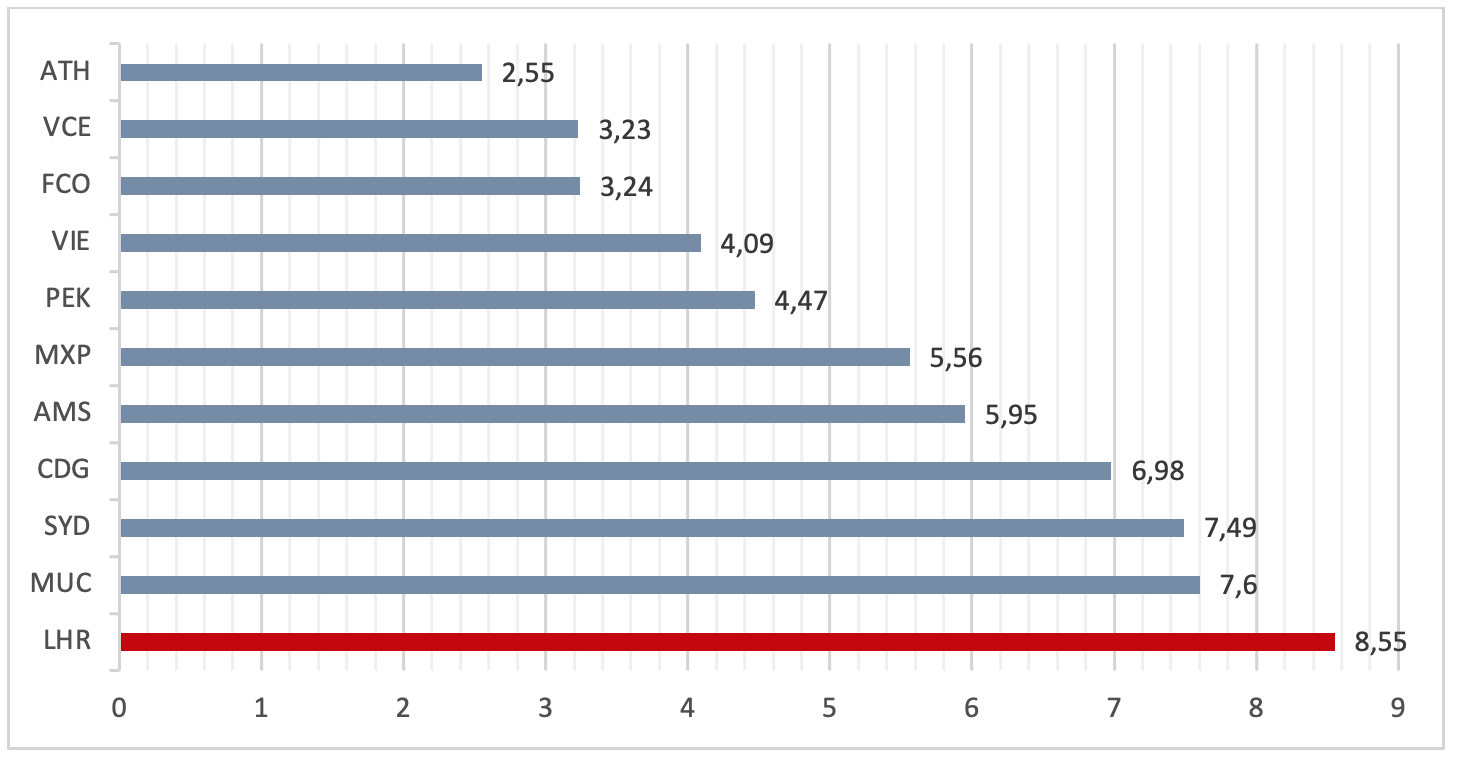

Although, not only airlines seem to implement ancillary revenues strategies to boost their revenues. According to CAPA (2019), 39.9% of airports revenues were generated from non-aeronautical sources, which include non-aeronautical revenues as expressed by per passenger expenditure, duty-free concessions revenues, commercial activities and infrastructure as well as non-aeronautical infrastructure. Airports Council International (ACI, 2016) stated that airports around the world achieved more than 64,3 billion dollars from ancillary revenues policies, presenting a surge of 3.6% regarding the previous year. London Heathrow Airport is an example of the importance of ancillary revenues for the airports. The graphs below (Graph 2 & Graph 3) present the comparison between Heathrow Airport and other UK airports, as well as the competitive scenery of the international market, regarding airports’ commercial revenues.

Graph 2: UK airports – Total commercial revenues per passenger SOURCE: CAA (2017)

Graph 3: Int. Airports - Total commercial revenues per passenger SOURCE: CAA (2017)

According to the graphs above (Graph 2 & Graph 3), London Heathrow Airport generates substantial revenues from its commercial activities. Serving more than 80 million passengers (Heathrow Airport, 2019), the airport achieved a profit of more than 100 million GBP per year, which is one the highest both inside the UK as well as the international market. Comparing to other European airports, London Heathrow presents impressive results which reflect the importance of ancillary revenues for the airport.

As a result, ancillary revenues seem to have an important role on airlines’, even airports’, strategies. Through secondary revenue sources, they try to boost the profits and create customizable products for each passenger.

A New Era for the Ancillary Revenues

Even though ancillary revenues introduced more than a decade ago, airlines tend to exploit all possible sources as well as integrate new technologies into their strategies. The evolution of the internet, as well as the introduction of Travel 2.0, in the tourism sector transformed the relationship between business and customer. (O’Connell & Warnock-Smith, 2013; Xiang & Gretzel, 2010).

Social media are some of the tools which airlines use to gain ancillary revenues from their passengers. China Airlines introduced a mobile application which passengers can pre-order their duty free, pre-select their meals and even choose their in-flight internet connectivity, providing a wide range of services for them (Airline Trends, 2018). The integration of social media in the ancillary revenue strategy became a major breakthrough for the industry and managers believe that they will be a driving force for the next years (SimpliFlying, 2019).

Moreover, it is highly interesting the investment of airlines into new technologies for the future. Recently, Spirit Airlines, Volaris and EasyJet announced the introduction of new software and baggage pricing technologies to increase their ancillary revenues (Blue Swan Daily, 2018), verifying the necessity of ancillary revenues for Low-Cost Carriers.

On the other side, traditional carriers like American Airlines also face an unexpected upselling which enables them to invest more on ancillary revenue tactics (Blue Swan Daily, 2018). According to CAPA and Panasonic Avionics (2018), such airlines change the traditional way of in-flight advertising and present a new variety of digital advertisements which can be adjusted to each passenger separately.

At last, Amadeus (2017) developed an airline ancillary service platform which allows airlines to maximize their sales opportunities by providing them the ability to present tailored solutions to their passengers’ and enabling consistent merchandising throughout the entire journey.

Ancillary revenues have entered in a new era due to the of expansion of internet evolution and technology. Airlines introduce new technologies which will boost their ancillary revenues and use social media to identify their customers.

Ancillary Revenues and Customer Perceptions

Airlines have a significant interest for the profile of their customers, their travel behavior as well as the level of willingness to purchase for an ancillary service (Leon & Udin, 2017). The importance of the human factor on the planning of an ancillary strategy may arise several dangers for they airlines and the consideration of such factor seem to be vital. First studies on the willingness of passengers to pay for ancillary services, conducted by Luengo-Prado (2004) and Mumbower et al. (2015), provided essential information on how passengers react on paying for extra legroom. Also, O’Connell & Warnock-Smith (2013) examined the acceptance of ancillary fees on international passengers.

As airlines move towards to ancillary fees for their passengers, they need to consider questions regarding price fairness, negative impact on passenger behaviour as well as fee acceptability from the customers (Tuzovic et al., 2014). The segmentation of the passengers and the service of the right product have become vital for the airlines.

Even though pricing is one of the least understood subjects from the passengers, the price fairness they obtain by the additional service seem to have great impact on their behavior as well as on the way they purchase them (Xia et.Al., 2004; Tuzovic et al., 2014). Customers’ acceptability of the paid service, their reaction to the provided service and the feedback for this experience, should be highly considered by the airlines. Moreover, the nature of the passenger and the purpose of its journey tend to play important role on their attitude against the ancillary revenue policy. For example, Rouncivell et. Al. (2018), identified that UK passengers have different behaviour on the way they face ancillary fees on domestic routes. They prefer to pay more for additional services when they are on a business trip rather than when they travel for leisure purposes. Although, these factors seem to change for the UK passengers on the long-haul routes which they are willing to pay (Lorenzoni & Pidgeon, 2006; Rouncivell et. Al., 2018).

The transition from “free” to “fee” was a challenge for the airlines and the reaction of their customers may have negative results. Emotions like anger or betrayal by the company could create complains as well as negative word of mouth, damaging airline’s reputation (Babin et Al., 2013). Although after all these years, passengers seem to be quite familiar with the ancillary revenue strategies and the influence of additional costs on their journey is relatively narrow (Tuzovic et al., 2014). Passengers are accepting the ancillary revenue tactics by the airlines and through the years they adjusted them into their travel philosophy.

The introduction of ancillary revenue policies has presented mixed results for the airlines. Customers’ willingness to pay for additional services has major impact on the airlines, which is justified of the extended scientific research. Customer perspectives regarding price fairness on ancillary revenue tactics effects critically the industry (Waguespack & Curtis, 2013) and creates a new scenery.

Ancillary Revenues in The Age of COVID-19: Heading to New Normal

The global pandemic introduced another great challenge for the financial viability of airlines. From the beginning of the health crisis the air transport sector faced a revenue loss of $252 billion (KPMG, 2021). However, revenue streams such as non-seat related profits remained a significant income generator for airlines and airports, in the pandemic. Low-Cost Carriers embraced the idea that passengers travel for different purpose, thus they focus on the secondary sources which customers needed at the time of the pandemic. Purchased packages, including bags, seat selection, ticket flexibility as well as revenues from excess weight baggage are only some of the few sources of profits for such carriers (GlobalData, 2021). Moreover, the extensive application of Omnichannel revenue platforms highlighted the ever-rising power of online ordering when combined with home delivery. Lufthansa’s Lufthansa’s WorldShop and Singapore Airlines’ KrisShop are only some of the airlines which embraced these opportunities (Raasch, 2020).

At the same time, the industry prepares to bounce back and several technological companies introduce platforms which allows both airlines and airports to focus on merchandising, customer relationship management (CRM) solutions as well as on providing insights for future revenue streams (Future Travel Expirience, 2020).

On the other side, airports introduce their own strategies to regain some of the lost profits. Several airports invest on the creation of mobile applications which will allow customers to continue their airports habits such as retail shopping, dining or customs clearance (Weber Bång, 2020) while keeping distances and stay healthy.

Conclusion and Discussion

Deregulation of the industry, in combination with fuel prices and entrance of new airline companies, narrowed the margin for profits. The need for a new revenue source was vital for the profitability and viability of the airlines. Ancillary revenues introduced a new trend to the airline marketing. Highly important for both airlines and airports, revenues from secondary sources rapidly became one of the driving forces for the industry and adopted from all airline business models (Warnock-Smith et. Al., 2017). Their constant increase through the last decade listed them as one of the top priorities for the airline managers and the evolution of these new revenue stream followed soon (Diggin Travel, 2018). Internet, social media, software technology as well as new travel behaviour boosted airlines to develop new ancillary revenue strategies and focus on each customer separately (Blue Swan Daily, 2018). As customers were in the middle of decision-making process, airlines need to understand their perceptions regarding these strategies. Several scientific inquiries conducted to reveal the level of acceptance, as well as the attitude, of passengers towards additional fees for non-ticket services. Customers seem to be sensitive on certain factors regarding ancillary revenue tactics, such as willingness to pay or price fairness (Tuzovic et al., 2014). Although, the acceptance of such policies by the passengers reveals a maturity of the phenomenon after a decade of introduction. At last, Covid-19 may have created several challenges for the industry, however heading to the New Normality both airlines and airports implement ancillary revenue strategies to boost their financial performance as well as to create a new environment for their customers.

References

Airline Trends, (2018). China Airlines mobile app lets passenger pre-order duty free, pre-select meals, and book high-speed rail tickets. Available at: http://www.airlinetrends.com/2018/10/24/china-airlines-mobile-app-innovation/ (Assessed 1 May 2021).

Amadeus, (2017). Merchandising ’17: Trends in Airline Ancillaries. Available at: https://amadeus.com/documents/en/airlines/research-report/merchandising-17-trends-in-airline-ancillaries.pdf?crt=DownloadRequest (Assessed 1 May 2021).

Amadeus (2011), “The Ancillaries Landscape: How Ancillaries are Changing the Economic Landscape for Airlines”, at http://2013.amadeusblog.com/wpcontent/uploads/2011/10/amadeus_data_centre_inforgraphic1.jpg

Air France, (2019). My Bookings. Available at: https://www.airfrance.co.uk/GB/en/local/core/engine/mmb/MmbAction.do (Assessed 1 May 2021).

Babin, B.J.,Griffin, M.,Borges,A.,Boles,J.S.,2013.Negative emotions, value and relationships: differences between women and men.J. Retailing Consum. Servi. 20 (5),471–478.

Civil Aviation Authority, (2017). Heathrow Airport – Review of Commercial Revenues. Available at: https://publicapps.caa.co.uk/docs/33/1563b_H7_Commercial_Revenues_report_by_SDG.pdf (Assessed 1 May 2021).

CAPA, (2019). ACI airport report: – economic impacts of non-aeronautical activities. Available at: https://centreforaviation.com/analysis/reports/aci-airport-report--economic-impacts-of-non-aeronautical-activities-452166 (Assessed 1 May 2021).

Diggin Travel, (2018). 2018 Airline Digital Merchandising White Paper. Available at: https://www.diggintravel.com/2018-airline-ancillary-revenue-trends/ (Assessed 1 May 2021).

EasyJet, (2018). Annual Report. Available at: http://corporate.easyjet.com/investors/reports-and-presentations/2018 (Assessed 1 May 2021).

Gustavo, N. (2013). Marketing Management Trends in Tourism and Hospitality Industry: Facing the 21st Century Environment. International Journal of Marketing Studies, 5(3).

Heathrow Airport, (2019). Facts and figures. Available at: https://www.heathrow.com/company/company-news-and-information/company-information/facts-and-figures (Assessed 1 May 2021).

Hoszman, A. (2015). Typology of Ancillary Revenue in Airlines. Journal of Management and Financial Sciences. 4(22):57-68.

IATA, (2018). Ancillary revenues expected to hit $92.9bn. Available at: https://airlines.iata.org/news/ancillary-revenues-expected-to-hit-929bn (Assessed 1 May 2021).

IdeaWorks, (2017). 2017 Top 10 Airline Ancillary Revenue Rankings. Available at: https://www.ideaworkscompany.com/wp-content/uploads/2018/07/2017-Top-10-Airline-Ancillary-Revenue-Rankings.pdf (Assessed 1 May 2021).

IdeaWorks, (2018). Airline Ancillary Revenue Projected to Be $92.9 Billion Worldwide in 2018. Available at: https://www.ideaworkscompany.com/wp-content/uploads/2018/11/Press-Release-133-Global-Estimate-2018.pdf (Assessed 1 May 2021).

IdeaWorks, (2019). Ancillary Revenue Defined. Available at: https://www.ideaworkscompany.com/ancillary-revenue-defined Assessed 1 May 2021).

KLM, (2019). Prepare for travel. Available at: https://www.klm.com/travel/gb_en/prepare_for_travel/index.htm (Assessed 1 May 2021).

Lee, H.-C., Tsai, D.C., Wu, M.-D., 2011.The dilemma of mixed bundles: the effects of price, brand, and content preference on music Cd bundle choices. J. Retailing Consum. Servi.18(5),455–462.

Leon, S. & Nizam, U. (Απρίλιος 2017). Airline Ancillary Services: An Investigation into Passenger Purchase Behavior. Journal of the Transportation Research Forum. 56(1):41-62.

M.J. Luengo-Prado. “Are Passengers Willing to Pay More for Additional Legroom?” Journal of Air Transport Management 10, (2004): 377–383.

Mumbower, S., L.A. Garrow, and J.P. Newman. “Investigating Airline Customers’ Premium Coach Seat Purchases and Implications for Optimal Pricing Strategies.” Transportation Research Part A 73, (2015): 53–69.

O'Connell, J. and Warnock-Smith, D. (2013). An investigation into traveler preferences and acceptance levels of airline ancillary revenues. Journal of Air Transport Management, 33, pp.12-21.

O’Connell, J., Warnock-Smith, D., Maleki, M. AN EXAMINATION OF ONGOING TRENDS IN AIRLINE ANCILLARY REVENUES. Conference records from the 19th Air Transport Research Society (ATRS) World Conference in Singapore by Air Transport Research Society (ATRS).

Onboard Hospitality, 2011. Increasing Revenue Streams: Ancillary Revenue. Available at: http://www.airlineinformation.org/AI_Company/documents/Ai_inthenews_OnboardHospitality_Feb2011.pdf

Rouncivell, A., Timmis, A. and Ison, S. (2018). Willingness to pay for preferred seat selection on UK domestic flights. Journal of Air Transport Management, 70, pp.57-61.

Ryanair, (2018). Annual Report. Available at: https://investor.ryanair.com/wp-content/uploads/2018/07/Ryanair-FY-2018-Annual-Report.pdf (Assessed 1 May 2021).

SimpliFlying, (2021). Airline Social Media Outlook 2019. Available at: http://simpliflying.com/2018/airline-social-media-outlook-2019/ (Assessed 1 May 2019).

The Blue Swan Daily, (2018). Volaris attributes increase in ancillary revenues to product maturity allied with new products. Available at: https://blueswandaily.com/volaris-attributes-increase-in-ancillary-revenues-to-product-maturity-allied-with-new-products/ (Assessed 1 May 2021).

The Blue Swan Daily, (2018). Panasonic Avionics: Inflight advertising poised to grow into major ancillary revenue stream. Available at: https://blueswandaily.com/panasonic-avionics-inflight-advertising-poised-to-grow-into-major-ancillary-revenue-stream/ (Assessed 1 May 2021).

The Blue Swan Daily, (2018). Spirit Airlines plans new technology push to grow ancillary revenue. Available at: https://blueswandaily.com/spirit-airlines-plans-new-technology-push-to-grow-ancillary-revenue/ Assessed 1 May 2021).

Tretheway, M.W., Markhvida, K., 2014. The aviation value chain: economic returns and policy issues. J. Air Transport. Manag. 41, 3–16.

Tuzovic, S., Simpson, M., Kuppelwieser, V. and Finsterwalder, J. (2014). From ‘free’ to fee: Acceptability of airline ancillary fees and the effects on customer behavior. Journal of Retailing and Consumer Services, 21(2), pp.98-107.

Waguespack, B. and Curtis, T. (2015). Ancillary revenue and price fairness: an exploratory study pre and post flight. International Journal of Aviation Management, 2(3/4), p.208.

Warnock-Smith, D., O'Connell, J. and Maleki, M. (2017). An analysis of ongoing trends in airline ancillary revenues. Journal of Air Transport Management, 64, pp.42-54.

Xia, Lan, Kent B. Monroe, and Jennifer L. Cox. (2004). “The Price Is Unfair! A Conceptual Framework of Price Fairness Perceptions.” Journal of Marketing, 68 (4): 1-15.

Xiang, Z. and Gretzel, U. (2010). Role of social media in online travel information search. Tourism Management, 31(2), pp.179-188.

Bång, M., 2021. Ancillary revenues in the age of COVID-19: 6 companies paving the way. [online] SimpliFlying. Available at: <https://simpliflying.com/2020/ancillary-revenues/> [Accessed 10 May 2021].

Future Travel Experience. 2021. 10 innovative solutions to help airlines and airports maximise ancillary revenues post-COVID-19. [online] Available at: <https://www.futuretravelexperience.com/2020/06/10-innovative-solutions-to-help-airlines-and-airports-maximise-ancillary-revenues-post-covid-19/> [Accessed 10 May 2021].

Omnevo 2021. Why Digital Will Drive Airline Ancillary Revenue in the Post-COVID-19 World | Omnevo. [online] Available at: <https://www.omnevo.net/insights/why-digital-will-drive-airline-ancillary-revenue-in-the-post-covid-19-world.html> [Accessed 10 May 2021].

Statista. 2021. Airline industry - ancillary revenue 2011-2020 | Statista. [online] Available at: <https://www.statista.com/statistics/788849/airline-industry-ancillary-revenue/> [Accessed 10 May 2021].

KPMG. 2021. Airlines and COVID-19. [online] Available at: <https://home.kpmg/xx/en/home/insights/2020/04/airlines-and-covid-19.html> [Accessed 10 May 2021].

Iata.org. 2021. [online] Available at: <https://www.iata.org/en/iata-repository/publications/economic-reports/airline-industry-economic-performance---november-2020---report/> [Accessed 10 May 2021].