|

The Importance of the Tourism “Multiplier” and its Effect on Economic Development |

|

Karagiannis Georgios University of the Aegean: Department of Statistics and Actuarial - Financial Mathematics, Greece |

|

Dimitrios Kovos Mechanical Engineer Design and Drafting, Sheridan College, Brampton, Ontario, Canada. |

Abstract

|

Κ = |

The present paper is an attempt to map the area of tourism, and outline the course and use of the “multiplier”. Its purpose is to locate the multiplier’s positive effects on both the national and the local level, and identify the interdisciplinary nature of the multiplier’s applications. In areas where there is incoming tourism, people know that their income, which is affected by tourist consumption according to the multiplier theory, is re-invested in order to further improve the tourist product offered. The main source of this knowledge, which is set out in the present paper, is both the literature on this subject, but also the responsible views of experts in the economics of tourism. Therefore, the secondary sources of information as well as the responsible viewpoints validate the present paper so that we can prove that each euro invested by tourists results in greater profit for the local economy.

Keywords: tourism, multiplier, demand, economics

- Introduction

At a time when many of the country’s economic indicators have significantly decreased due to a general financial crisis and the lack of a meaningful supportive economic policy, we decided to work on the subject of the multiplier, particularly the tourism multiplier. First, we shall present the form of the multiplier (Prof. Erwin Dichtl Otmar Issing 2004), which is the ratio of the change in income (increase) to the change in investment (increase) which causes the change in income (increase).

Therefore, if we express the multiplier as Π, the change in income as ΔΥ, and the change in investment as ΔΙ, then we get:

Π = ΔΥ/ ΔΙ and ΔΥ = Π.ΔΙ

Assuming that the change in income (increase) is 100.000 euros, and the change in investment is 20.000 euros, the result is:

Π = ΔΥ/ΔΙ = 100/20 = 5

Ultimately, we will have a multiplying process where an initial increase of 20.000 euros (for example) in an investment in public works will lead to an increase of about 100.000 euros in total income. ( Samartzis, G. 1992).

While the comparative-statistical analysis of the investment multiplier and the consumption multiplier are represented solely by the sum of the changes in the national income, there are many who present the progress of the national income as gradual, via the change of an independent variable with the help of a time lag. Here, as an example once again, we shall use the net investment as the independent variable, and the result shall be used to present an additional multiplier, the “consumption multiplier”. This multiplier emerges when the equation for the market balance of goods is set with regard to autonomous consumption: dY/dC=1/1-c, and the consumption multiplier correlates to the amount of the investment multiplier. For instance, an autonomous change in consumption may occur when the future expectations of economic units are positive, resulting in an increase in consumption despite the income remaining fixed. (Sakka, Andriana 2012).

Since the majority of multipliers created (expenditures, transactions, investments, etc.) are used in the process of their calculation, we can observe that the said process is almost the same for everyone, so we will delve into the case of the tourism multiplier. (Lamprinidis, M. 1996). It should be noted that the advocates for tourism often refer to its benefits, stating that the positive effects of the tourism multiplier on the national economy are clearly evident. Essentially, it concerns the effects of tourist expenditure within a year with doubled economic effects.

- The Invention of the Tourism Multiplier

The tourism multiplier was invented many years ago, and it was mostly based on the Keynesian Keynes, (John Maynard 1982) & (Kromphardt, Clever, Clippert 1980) principles of recirculation of part of the income by its recipients in the form of consumption expenditure which then creates more income and activity. The basis for calculating a simple multiplier is the direct cash influx in an economy, e.g. via tourist expenditure, which naturally implies higher income for the providers of tourist services; eventually, this will be distributed in the form of wages, salaries, rents, interests, profits, and a percentage of it even as indirect income to the providers of goods and services, who contribute to the organization and operation of tourist businesses. (Laloumis D., Roupas, B. 1998).

It should be noted that the indirect income, which is distributed to providers of food and drinks, public interest services (electricity and phone services), fuel stations, printers, etc., is identified in the form of payments to providers. Eventually, any entrepreneur in the aforementioned fields with increased income can spend or save these increases. If he chooses to spend them on the production of goods and services, then the trade cycle creates increased income for the providers of a secondary activity, who in turn have more money available to spend. The original function of the multiplier in practice is outlined in the figure below.

Figure 1. The original function of the multiplier

Therefore, the value of the multiplier demonstrates the total sum of the income or the amount of any variable calculated in relation to the initial influx or tourist expenditure. In the example presented in the following Picture, the initial expenditure is 1.000 euros, 500 of which are re-spent in the economy; an amount of 250 euros of this sum enters into circulation again, and so on. Thus, the total value of income created within a specific time period is the sum of the following geometric progression: 1.000 euros + 500 euros + 250 euros + 125 euros = 2.000 euros. Since the total value of the income of 2.000 euros is double than the initial expenditure of 1.000 euros, then the value of the multiplier in this specific case equals 2. The value of 2 is directly associated with the recipients’ income habit of re-spending the specific sum. Therefore, in each round, they re-spend half of the additional income, which is defined as marginal propensity to consume. (Bull, Adrian 2002).

- Working Hypothesis

In order to determine the multiplier, we simply need to report that the amount of 1.000 € in tourist expenditure affects the economy as an income of 2.000 €, (e.g.) in a community of incoming tourism, in which tourist expenditure is calculated in a time frame of one year. (Exarchos, G. 2008). It is evident that tourist production and tourist consumption generate a series of direct effects, at both an immediate and a later stage. The immediate effects correspond to the distribution of the added value. As regards the consumption of goods and services, it creates a new final demand, which generates new added value, and new intermediate consumption. The income growth rate is called “income multiplier”. (Erbes, R. 1975).

From the aforementioned facts, we can conclude that the resulting added value constitutes an early indicator of the contribution of the tourism sector to the national income of a country. (Varvaresos, Stelios 2000).

- A Practical Example

The advocates of tourism often point to the beneficial effects that a multiplier has on the national economy which is the effect of tourist expenditure within a year, and where said effect is “spent”, considering that its level cannot be calculated (Mueller, Heinz 1978) although we do know that the economy is impacted in each cycle of tourist expenditure, with the positive effects being doubled. Below we present a table examining the tourism multiplier. (Karagiannis, S., Exarchos, G. 2015).

Tourism Multiplier

|

Working hypothesis of a “Tourist Expenditure” of 1.000 euros |

|

|

1.000,00 |

--------------- |

|

500,00 |

(1/2) x 1.000 |

|

250,00 |

(1/2)2 x 1.000 |

|

125,00 |

(1/2)3 x 1.000 |

|

62,50 |

(1/2)4 x 1.000 |

|

31,25 |

(1/2)5 x 1.000 |

|

15,63 |

(1/2)6 x 1.000 |

|

7,81 |

(1/2)7 x 1.000 |

|

The 1.000 € had an effect of 2.000 € on the economy. |

|

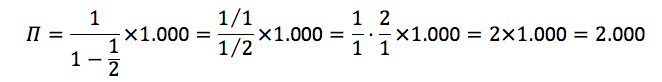

The tourism multiplier shows how the initial 1.000 € of tourist expenditure spent within a year in a community of incoming tourism becomes an income of 2.000 €. The multiplier formula is:

The multiplier theory was propounded – as early as 1939 – by the renowned American professor and Nobel Prize winning economist Paul A. Samuelson, and operates in relation to tourism based on the following formula:

Tourist expenditure in a country depends on the tourists’ change in income and their consumer behavior. This percentage, known as the MPC, reflects the potential for consumption of an economy, neither the desire or need to consume.

Example: If ΔΥ: 3.272 € and ΔC: 2.272 €

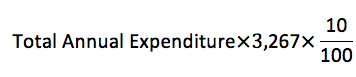

Based on the data in our example, when the total tourist expenditure is multiplied by 3,267, it results in a minimum level of activity as an effect of tourist expenditure within a year. This means that this multiplication (Tourist Expenditure x Multiplier) gives us the amount of income generated by tourism.

If we wish to evaluate the aforementioned case in further detail, by examining every tourist expenditure in every hospitality business, it appears that every 1 € spent/consumed by a tourist during his stay results in a consumption of at least 2 € in that particular economy. This demonstrates that countries with incoming tourism should carry out vigorous marketing – management strategies (Karagianni, St. Maria 2017). and make efforts to promote the tourist product that yields positive results. Thus, such efforts ought to be organized and planned so that they have the support of the local community and lead to the advancement of the overall growth of tourism. Finally, it should also be pointed out that the contribution of tourist expenditure to the tax revenue of the country of destination, can be calculated based on the following formula – if, for instance, the income tax is 10%:

Therefore, tourist expenditure contributes to the development of a positive economic correlation between cost and profit, meaning that the correlation is positive when for every euro invested in tourism growth the result is a profit of at least five euros.

Conclusion

In conclusion, we can assert that the tourism multiplier shows that an initial sum of 1.000 € of tourist expenditure turns into an income of 2.000 € in the community in which they are spent within a year. Therefore, tourist expenditure contributes to a positive cost-profit economic correlation, meaning that for every euro invested in tourism growth, the result is a profit of at least five euros. When it comes to countries which are relatively developed and have successful tourist programs in place, this correlation may be 1 € to 30 € and up to 1 € to 50 €, while for industrialized countries which are less economically dependent on tourism, the correlation may start at the level of 1 € to 50 € and surpass 1 € to 100 €. Thus, from the moment a tourist pays the hotelier, the restaurateur, the travel agent, etc., this money is added to the income of business people involved, and then to the national income of the country or the place of the incoming tourism. Finally, it should be noted that the economy does not immediately consume or react to this money flowing in.

In view of the above, the contribution of tourism to the economic development of any country should be stressed, and efforts should always be exercised for its advancement. Tourism is an element of success in any society, and people should realize its importance. A proper tourism policy which offers a correct tourist product will attract visitors from all over the world, and will generate income for the current generation and the generations to come.

BIBLIOGRAPHY

Bull, Adrian (2002). Tourist Economy, Kleidarithmos Publications, Athens, pp. 216, 217.

Erbes, R. (1975). Le Tourisme International et l’Economie des Pays en Voie de Development, OCDE, Paris, pp. 1-5.

Prof. Erwin Dichtl Otmar Issing (2004), Vahlens Großes Wirtschafts Lexikon, Herausgegeben von Erwin Dichtl und Otmar Issing, Band 3, 2 Auflage, Seite 1501.

Exarchos, G. (2008). Private Economics. Anikoulas Publications, Thessaloniki, p. 347.

Judit Grotte (2017): Global Trends in the Hospitality Industry, pp.114-124., In: ICUBERD, Book of Papers 2017, University of Pécs, ISBN 978-963-429-212-8

Karagianni, St. Maria (2017). Culture Sustainability Policy-Aspects of the Greek Society, Monograph, Publ. Dionikos, pp. 70-71.

Karagiannis, S., Exarchos, G. (2015). Tourism: Economy, Development, Policy, Diavlos Publications, Athens, p. 167.

Keynes, John Maynard (1982). Allgemeine Theorie der Beschäftigung des Zinnes und des Geldes, Verlag Karl Ueberreuter, Wien, Seite 236.

Kromphardt, Clever, Clippert (1980). Methoden der Wirtschafts und Sozial Wissenshaften, Verl. Cabler, Seite 29.

Laloumis D., Roupas, B. (1998). Management in Tourism, Stamoulis Publications, p. 333.

Lamprinidis, M. (1996). Macroeconomic Policies, Specific Issues, Panteion University, p. 8.

Mueller, Heinz (1978). Methoden zur Regionalen Analyse und Prognose, Taschenbücher zur Raumplanung, Hannover, Hermann Schroedel Verlag, Seite 47-48.

Sakka, Andriana (2012). Macroeconomic Theory, Economic and Policy Applications, Propompos, pp. 125-127.

Samartzis, G. (1992). Macroeconomic Data (with Tables from the Greek Economy), Rhodes, pp. 46-48.

Varvaresos, Stelios (2000). Tourism – Economic Approaches. Propompos Publications, p. 241.