Multi Channel Strategy: An Empirical and Theoretical Analysis of Online Distribution Channels in the Hospitality Industry

|

Steinhauser, Carolin Professor of International Hospitality Management at Campus Dresden, SRH Hochschule Berlin - The International Management University, Dresden, GERMANY |

|

Bohne, Hartwig

Professor of International Hospitality Management at Campus Dresden, |

ABSTRACT

The term multi-channel management is already widely used in the tourism industry and essentially means that the tourist offer is sold to guests via more than one distribution channel. The guest of today searches in different places, at different times and via different media, to satisfy his or her need for inspiration and information (Beritelli/Schegg 2016). Distribution policy (“place") was initially a rather neglected instrumental area in the classic marketing mix (Freyer 2011).

However, as the mostly digital development of services as well as information and communication technologies progresses, differentiated considerations are necessary for a distribution policy. The distribution policy in the hotel industry is extremely fast-moving and it is hardly possible for the private hotel industry in particular, to maintain an overview of current developments, the necessary know-how for implementation, as well as time and financial resources and the training of relevant employees for these challenges. (Steinhauser/Theiner 2016).

The aim of this paper is to analyse the development of different distribution channels on the market. Therefore, online aspects of distribution, specifically OTAs (Online Travel Agencies) (Schegg 2014) and meta-search engines with new business models (Kästner 2015, Steinhauser 2015) are investigated. The second part is an empirical survey of the significance and success of the individual sales measures (Steinhauser 2018). For this, we collected data on 137 hotels in Germany between November 13th and December 31st 2017 with an online survey, and asked 20 questions about the importance of the different distribution channels and how the hotel industry is positioned in the online field. Thirdly, four hypotheses were formulated and tested via SPSS, according to cost per click budgets, expense for sales, commission fees for OTAs.

As a result, we are able to publish interesting considerations on the online affinity of the hotel landscape we investigated. We will show which are the most important distribution channels and how interfaces to portals such as trivago or tripadvisor are already being used in the market. On the basis of this research, hoteliers can develop a long-term, effective and efficient multi channel strategy for their hotels on an individual basis. More knowledge helps to obtain a better estimate of individual measures and budgets and enables a sophisticated benchmarking according to competitors.

Key Words: Distribution channels, OTAs, commission fee, new business models, pay-per-click model

INTRODUCTION

Multi-channel management is an important instrument of the hospitality industry, used to widen the number of distribution channels for the successful sales of rooms. As guests of today are used to searching and to comparing in different places with a greater flexibility and less loyalty, they are looking permanently for new sources of information for their optimized strategies of efficient booking processes. Therefore, individual hotels as well as standardized hotel chains have to adapt their marketing tools and concepts in order to encounter potential guests at the right moment and in the right place, in order to convince them with the best offer.

Additionally, the fast development of digital sales platforms and meta search engines, as well as the growing demand of customers for transparency and quick response rates, lead the hotels and chains to evaluate their sales structures and market entry strategies regularly. Consequently, they have to consider the cost structure as well as the relevant target groups, in order to invest in the profitable sales measures.

This analysis offers significant data about the contemporary distribution channels and their influence on hoteliers’ decision processes, as well as for sales and buying activities.

Research Design and Hypothesis

In our empirical study, we collected data from 137 hotels in Germany from November 13th to

December 31st 2017 with an online survey and asked 20 questions about the importance of the different distribution channels and how the hotel industry is positioned.

The aim of this paper is to analyse the development of online distribution channels and in particular to look at cost-per-click models (used by meta searcher) and commission fees of OTAs. This study is based on a deductive approach, which means that we start with a compelling social theory, test its implications, and collect data. That is, we move from a more general level to a more specific one. Looking at the literature, 3 hypotheses (h1, h2, h3) emerge to investigate:

Hypothesis 1 (h1): Individual hotels (incl. cooperations) pay higher commission rates to OTAs[1] than brand/chain/franchise hotels

Hypothesis 2 (h2): The larger the hotel, the more budget is available for cost-per-click models per month.

Hypothesis 3 (h3): Hotels with higher turnover spend more money on cost-per-click models

Our objectives are to describe how and why online distribution channels (especially OTAs) develop in this direction and to provide answers to our above-mentioned hypotheses.

Empirical and theoretical analysis

Naturally, one of the main aims of the sales department is to sell the product (= hotel room) and thus to ensure the highest possible capacity utilization or turnover. Nevertheless, the objective of the distribution policy must be further defined. The distribution policy covers all decisions about the way your hotel is offered to your guest (Meffert/Bruhn 2006, p. 592) and these ways can be very varied. The German Hotel Association (IHA) and the Institute for Tourism of the university Westschweiz Wallis conducted an online survey of hotels from January to April 2014.

The aim of this survey was to determine the development trends of the most important sales channels and market shares. This survey updates the survey conducted in 2011 by the German Hotel Association (IHA), the Austrian Hotel Association (ÖHV) and hotelleriesuisse. 1.193 individual and chain hotels took part in the online survey 2014 in Germany. The survey shows that the telephone, i.e. the contact via one's own hotel staff, is still the most important channel. More than 26% of overnight stays in German hotels are booked by telephone. This means that the importance of the telephone in Germany has even increased slightly, compared to 2011. (Hotelverband Deutschland (IHA) (2015) In practice, it was found that it is often the case that many guests look at the hotel online to inform themselves, and then make a call because they still have questions, cannot use the online booking function or do not want to transmit their payment data online. For this reason, great attention should be paid to the training and qualification of the employees who advise guests on the telephone or on-site.

- Table 1: Distribution channels of hotels in Germany from 2011 to 2013 (according to Hotelverband Deutschland (IHA) 2015, S. 241)

The manifold channels of distribution policy show that sales in a hotel should be explicitly planned and not simply implemented without strategic considerations. A broad-based sales network can be used to strengthen the company's market position. By increasing the degree of distribution and the associated increased presence and better accessibility, the probability of being found by the guest is simply higher (Beritelli/Schegg 2014). In these times of Internet transparency, this can mean a decisive competitive advantage (Gardini 2010).

Looking at our own research, (N=133) we got similar results, but in our study OTAs (=IDS) are the most important distribution channels (27,3%), followed by telephone (19,1%) and email (18,5%) (N=133). Social media does not play a major role in distribution, it is more a communication channel than a distribution channel.

Table 2: Percentage share of online distribution channels (Steinhauser 2018)

The graphic shows the dominance of online travel agencies in the market. It is therefore necessary to go into more detail and look at the OTA players in the market and the commission structures to decide which partner is the right one for each hotel, and to develop a useful multi-channel strategy.

Online Travel Agencies

Online Travel Agencies, or OTAs for short, have had a massive impact on sales in the hotel industry in recent years. OTAs collect hotel offers from all over the world and give users or potential guests a better overview as well as saving them time, due to the diverse and sophisticated selection options. Often the guest profits - incomprehensibly - even today from the fact that the OTAs offer them better prices and conditions than direct bookings through the hotel websites. (Thakran/Verma 2013) This gives OTAs a major competitive advantage in direct comparison. Depending on guests preferences, offers can be filtered according to location, hotel category, hotel brand, room equipment, ratings, price or payment options. The user has learned that the systematic and standardized filtering of the content facilitates the final selection.

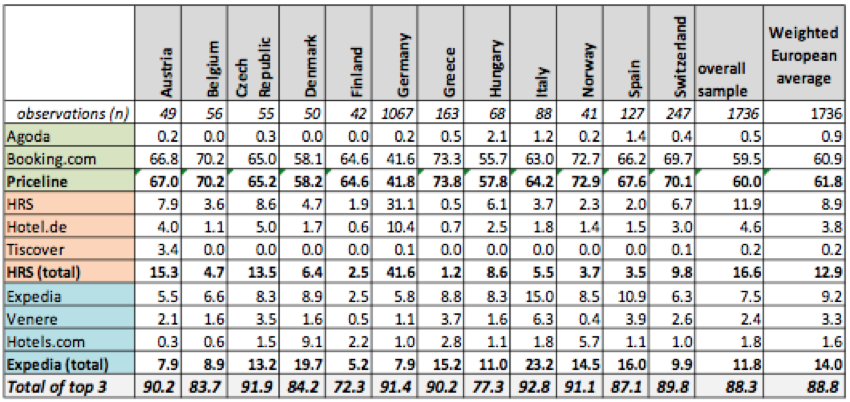

Table 3: Weighted market share of OTAs in Europa (According to Schegg 2014

More comprehensive information can often be found in the descriptive text passages and in the symbols provided indicating particular services rather than on the individual hotel websites. This "information asymmetry" has to be rectified by the hotel providers and similar data including the prices, in quality and quantity, have to be presented on their own website as well. The share of bookings made via online systems in the private hotel sector is around one third, while up to 70% of Hotel Group's business already comes from these sources. (Goerlich / Spalteholz 2014) Especially in times of weak demand, the OTAs are an important sales channel which help hotels to avoid vacancies (Anderson 2011). An overview from 2011 shows the most important OTAs in Germany, are HRS.de/Hotel.de and booking.com. Following the takeover of hotel.de by HRS in September 2013, these two companies in particular hold the largest share in the business. The strongest competitor of HRS in the defined hotel portal market in Germany is booking.com (Zöttl 2014).

The portal "booking.com" dominates the online hotel landscape to a large extent. Through the strategy pursued in recent years to also reach the "tail-end" of the hotel business, i.e. to integrate small hotels, not located in cities, as providers into the portal, booking.com, has not only gained attention, but has also mediated a lot of business to medium-sized hotels. If one follows the current feedback from the field, then booking.com is currently the most important OTA channel with many hotels in their portfolio.

Table 4: Weighted market share of the 3 top OTAs in selected countries

(according to Schegg 2014)

There are also country-specific differences in the distribution of individual OTAs. While HRS is very strongly represented in Germany, Priceline is dominant in Switzerland and Expedia in Italy. Table 4 clearly shows which individual platforms belong to the 3 major OTA representatives on the market. The hotel market is increasingly consolidating into the 3 dominant providers: Priceline, HRS Group and Expedia.

Many small and medium-sized enterprises are strongly challenged by the large number and variety of portals (Toh et al. 2011). The current challenge in sales is not to run multiple channels in parallel, but rather to provide them with useful information and data and to network them with each other. In our own study, the hoteliers were asked about the percentage distribution of their total OTA bookings. Again, booking.com was the strongest OTA channel with over 56%, followed by HRS (incl. hotel.de).

Table 5: Share of OTA bookings in percentage (Steinhauser 2018)

In a second step, it is important for the planning of the distribution strategy, to ascertain which commission rates are to be paid to the respective portals, in order to work as cost-efficiently as possible. It is striking that HRS and booking.com charge approximately the same average commission rates (14%). However, Expedia is a much more expensive sales channel for the hoteliers (note: it is absolutely understandable that the hotel's own website is by far the most favourable channel).

Table 6: Average commission rates for OTAs and hotel website in percent (Steinhauser 2018)

If you examine the actual practice, the question for the hotel industry is whether the commissions for all hotels are similar and therefore the average values are meaningful, or whether there are big differences. It would seem obvious that chains and large brand hotels in particular would receive significantly better commission rates than private or individual hotels. From this assumption, the following hypothesis can be formulated:

Hypothesis 1 (h1): Individual hotels (incl. cooperations) pay higher commission rates to OTAs than brand/chain/franchise hotels

For this purpose, the responding hotels were divided into 2 groups: On the one hand were the private and cooperation hotels and on the other hand, the hotels belonging to a brand/chain/franchise. At first glance, differences seem to exist in descriptive analysis, but the question now is whether these differences play a significant role?

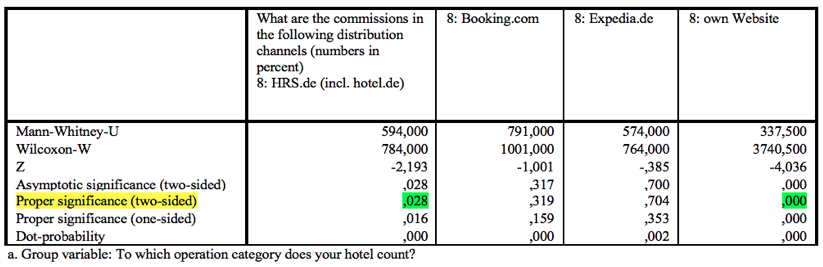

This hypothesis was examined with the help of SPSS and tested for its significance with regards to the different portals.

Table 7: Average commission rates for OTAs and hotel website in percent according to types of hotels (Steinhauser 2018)

Table 8: Average commission rates for OTAs in percent via SPSS (Steinhauser 2018)

In the case of HRS, there is a significant difference between Individual, Cooperation (mean rank = 56.17) and Brand/Franchise/Chain (mean rank = 41.26) -> U = 594.00, p = 0,028. The commission rates of HRS are higher for Individual/Cooperation than for Brand/Franchise/Chain. There is a highly significant difference in the commission rates for your own website between cooperation, individual (mean ranking = 45.62) and Brand/Franchise/Chain (mean ranking = 72.75) ->U = 337.50, p =. 000. In summary, it should be noted that there is a significant difference for HRS between private/cooperation and Brand/Franchise/Chain. This cannot be uniquely attested for the booking. com (p=0.319). The significant difference (p=0,000) with the own hotel website is also well understandable, because private hotels usually only pay very low commission fees (or even nothing) to the Internet Booking Engine agency of their website. In contrast all chain hotels usually pay a higher commission at their parent company for a reservation over the own brand website.

The commissions of the OTAs mentioned above are paid according to the pay-per-order system, which means that a fixed commission rate is payable when a booking is made. However, pay-per-click models are often used nowadays as well, which are explained in more detail below.

New Business Models

While traditional business models focus on a large vertical span of activities, new models are distinguished by large horizontal business portfolios, with a smaller vertical range typical of manufacturing (Bieger/Rüegge-Stürm 2002). As a meaningful example, business models in the online distribution sector are changing dramatically at the moment. Traditional online business models are based on fixed fees, according to received revenues, with commissions between 15% and 30% of booking value (the so called cost-per-order or cost-per-acquisition models). With the cost-per-order business model the hotel has no risk, provides the OTA with prices and availabilities and guests book and pay directly via the booking portal (e.g. HRS). Until arrival, guests are in contact with the OTA and not with the hotel. Today, there are even newer “pay-per-click models”, which are more challenging and with a higher risk on the hotel’s side. Pay-per-click suppliers are independent from booking revenues since these companies receive money for each click, even if there is no realized booking. Hotels have to collaborate with licensed interface providers and have to define a cost-per-click (CPC) budget. These new pay-per-click models are already established in a similar way at trivago, holidaycheck, tripadvisor, weg.de and google adwords (Kastner, 2013). This direct interface to meta search engines such as trivago enables the hotel to obtain direct bookings, generated by its own booking engine. These bookings are not commission-free due to the cost-per-click procedure, but they do not run through an OTA or another tour operator. However, monetary and time investments are needed to establish these interfaces. In addition, it is important to monitor the bookings made via these interfaces in order to assess the success. To do this, the conversion must be kept under control. As you can see in our study, 66% (n=90) of the hotels do not have an interface to metasearch portals like trivago, tripadvisor or google adwords. 34% (n=46) have an interface and spend on average EUR 5740 (Median: 1000) for these interfaces per month. Apparently, there are some hotels which condone very high dues per month and thus invest several thousand euros per month on interfaces while the average is EUR 5740. There is no hotel with more than 99 rooms that has no interface. It is striking that especially larger hotels are well connected and this has now become a “must have” in the industry.

For the cost-per-click models, a budget has to be provided by the hotel. The question which arises is whether large hotels provide more money than small hotels. This leads to the following hypothesis:

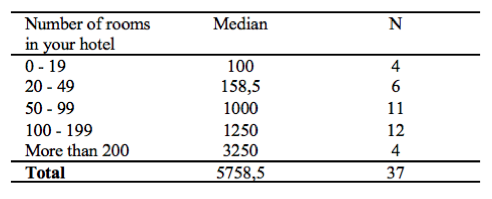

Hypothesis 2 (h2): The larger the hotel, the more budget is available for cost-per-click models per month.

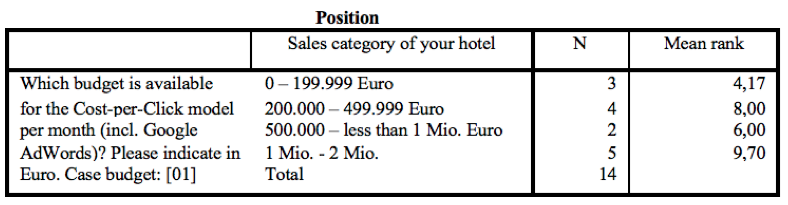

The hoteliers surveyed were able to classify the size of their hotel into 5 categories, and the median and sample size are shown in the following table (N=37). These hotels have indicated that they provide a budget for pay per click models.

Table 9: Sample Size for hypothesis 2 (Steinhauser 2018)

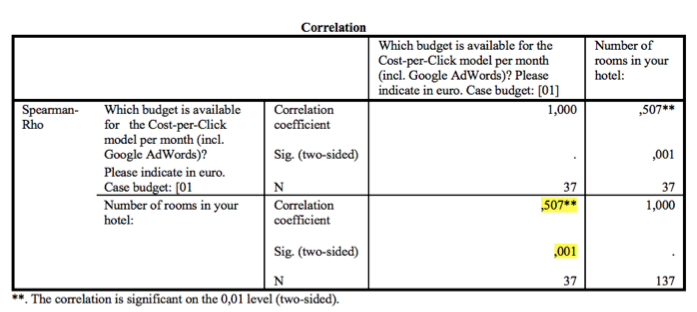

Table 10: Budget for cost-per-click models (Steinhauser 2018)

Our study shows that budget increases with the increasing number of rooms. It can be seen that there is a highly significant correlation between the budget and the number of rooms with r =.51, p =.001. The effect of the correlation is very strong with r =.51. If the size of a hotel determines the expenditure for pay per click models, the question arises whether this also applies to hotels with high turnover, i.e. whether there is a correlation between the turnover of a hotel and the budget for cost-per-click models?

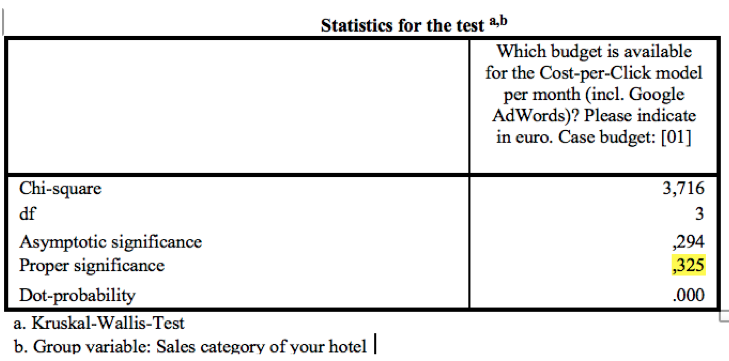

Hypothesis 3 (h3): Hotels with higher turnover, spend more money on cost-per-click models

Table 11: Budget for cost-per-click models (Steinhauser 2018)

There are no significant group differences with respect to the budget Chi-square (3) = 3,716, p =. 325. Thus it can be stated that the turnover of a hotel has no influence on how much the hotels spend on cost-per-click models per month and the hypothesis 3 cannot be proven.

4. Conclusion

Sales and distribution in the hotel industry have changed considerably in recent years. Some big players in the OTA market strongly influence the distribution situation of the tourism industry. As a result, this paper is able to publish interesting considerations with regard to the online affinity of the investigated hotel landscape. Although the phone is still a very important sales channel, our empirical study found that more than 27% of all hotel bookings are realized via OTAs. Therefore, OTAs are the most important sales channel in the hotel industry. booking.com is the portal with the largest market share in Germany, followed by HRS and Expedia. The commission structures of booking.com and HRS are very similar, with approx. 14% on average (approx. 16.4% for Expedia).

However, there are significant differences between the commission fees for private/ cooperation hotels and Brand/Franchise/Chain hotels on the portal HRS. Brand/Franchise/Chain hotels benefit from lower commission fees than individual hotels. While a pay-per-order models are used by the OTAs mentioned above, there are more and more pay-per-click models on the market. These models need to be deeply observed, because the conversion rate indicates how successful these models are. Large hotels spend significantly more money on pay per click models than small hotels with few rooms. However, this correlation cannot be proven for hotels with a high turnover. Therefore, there is no significant correlation between the turnover of a hotel and the expenditure on pay-per-click models.

Due to the high importance of OTAs in the hotel industry, it is especially essential to track them well and keep an eye on the commission rates. Only then is it possible to develop a meaningful multi-channel strategy and work as cost-efficiently as possible.

On the basis of this information, hoteliers can develop a long-term effective and efficient multi channel strategy for their hotels individually. This data can help to obtain a better estimate of individual measures and budgets and enables a sophisticated benchmarking according to competitors.

REFERENCES

Anderson , Chris (2011): Search, OTAs, and online booking: an expanded analysis of the billboad effect, in: Cornell Hospitality Report, Jahrgang 11, Nr. 8, p. 14.

Beritelli, Pietro / Schegg, Roland (2016): Maximizing online bookings through a multi-channel-strategy: effects of interdependencies and networks, in: International Journal of Contemporary Hospitality Management, Jahrgang 28, Nr. 2, 2016. p. 68-88.

Bieger, Thomas & Rüegge-Stürm, Johannes (2002), Net Economy - Die Bedeutung der Gestaltung von Beziehungskonfigurationen, in: Bieger, Thomas et al., Zukünftige Geschäftsmodelle pp. 15-33, Berlin.

Freyer, Walter (2011): Tourismus-Marketing: Marktorientiertes Management in der Mikro- und Makroberiech der Tourismuswirtschaft, München.

Gardini, Marco (2010): Grundlagen der Hotellerie und des Hotelmanagements: Hotelbranche. Hotelbetrieb – Hotelimmobilie, München.

Goerlich, Barbara / Spaltheholz, Bianca (2014): Das Revenue Management Buch 3.0, Berlin

Hotelverband Deutschland (IHA) (2015): Hotelmarkt Deutschland 2015, Bonn.

Kastner, Ulrich (2013), CPC -Die Neue Währung des Internets, in: http://www.hotellerie.de/de/cpc-die-neue-waehrung-des-internets, (14.5.2014).

Kästner, Katrin (2015): Distribution und Preispolitik: Meta- Suchmaschinen im Aufwind, in: Baierl, Ronny / Steinhauser, Carolin (2015): Rundum erfolgreich im Hotelmanagement: Dimensionen und Perspektiven im 360° Blick, p. 147–152, Bad Wörishofen.

Meffert, Heribert/ Bruhn, Manfred (2006): Dienstleistungsmarketing: Grundlagen – Konzepte, Methoden, Wiesbaden.

Schegg, Roland (2014): European Hotel Distribution Study: The Rise of Online Intermediaries, Institute of Tourism, Special Focus Switzerland, HOTREC.

Steinhauser, Carolin (2015): Neue Geschäftsmodelle durch neue Provisionsstrukturen am Beispiel des Pay-per-Click-Prinzips, in: Baierl, Ronny / Steinhauser, Carolin (2015): Rundum erfolgreich im Hotelmanagement: Dimensionen und Perspektiven im 360°-Blick, p.159–167.

Steinhauser, Carolin / Theiner, Barbara (2016): Hotelvertrieb 3.0: Ihr Weg zur besseren Zimmerauslastung, Stuttgart.

Steinhauser, Carolin (2018): Studie Hotelvertrieb in Deutschland, via: https://www.hochschulcampus-dresden.de/de/news-detail/news/aktuelle-studie-zum-hotelvertrieb-in-deutschland/ (1.3.2018).

Thakran, Kanika / Verma, Rohit (2013): The emergence of hybrid online distribution channels in travel, tourism and hospitality, in: Cornell Hospitality Quarterly, Jahrgang 54, Nr. 3, p. 240-247.

Toh, Rex S. / Raven, Peter / DeKay, Frederick(2011): Selling rooms: hotels vs. third-party websites, in: Cornell Hospitality Quarterly, Jahrgang 52, No. 2, p. 181-189.

Zöttl, Johannes (2014): Kartellamt untersagt Meistbegünstigung (“HRS”), in: http://kartellblog.de/2014/02/02/kartellamt-untersagt-meistbeguenstigung-hrs/ [11.9.2016].

[1] OTA= Online Travel Agency